Increase in Malta Social Security rates for 2025

The 2025 Malta Social Security (MSS) rates have been released, with a maximum increase of under 4% effective from 1 January.

Under EU Regulation 883/2004, seafarers who are EU/EEA or Swiss citizens or residents, and employed on vessels flying the Malta flag, must be insured under the Malta Social Security system. This regulation ensures that yacht crew members receive critical benefits and legal protections while working internationally.

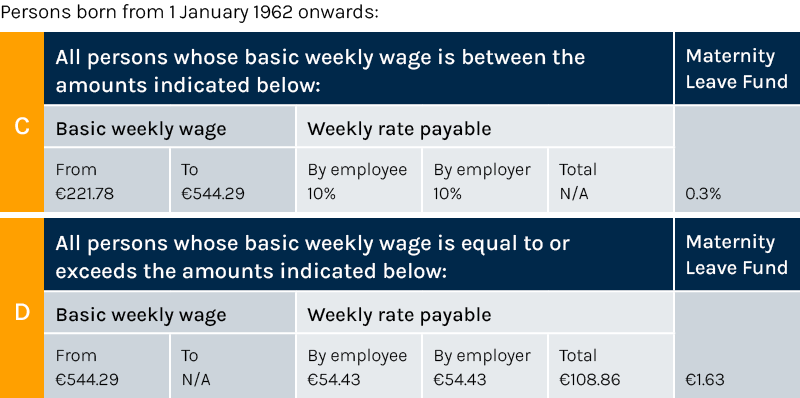

MSS rates from 1 January 2025

Understanding the requirements, submitting the correct forms, and staying up to date with the latest rates are essential to avoid complications and comply with Maltese regulations.

We have provided crew employment and payroll services for many years, and have the expertise, infrastructure and processes in place to make Malta contributions for all applicable crew. Our Crew Classic clients have direct access to our crew team, who are on hand to support individual crew members and to answer any questions regarding social security.

Our Crew LITE service provides crew employment and payroll services for a fixed fee per crew member per month. We can facilitate MSS and pension deductions as part of this service, which includes a self-service portal enabling captains and crew to manage their employment, qualifications and payroll data.

Additionally, in this technical Q&A on MSS, our Crew Services Officer Fiona Millo guides yacht crew and those managing maritime operations through their obligations.

Key contact